Advocacy pressure points for gender equality and macroeconomics: Further resources

Advocacy pressure points for gender equality and macroeconomics: Further resources  Banking system

Banking system

Annexe I: Basic concepts of macroeconomics

At the international level

- Definition and functions of money

Money is an item we use every day to buy and sell goods and services. Standard economic texts typically identify three main functions of money.1 See OpenStax Economics. (18 May 2016.) Principles of Economics. Chapter 27.1 “Defining Money by its Functions” Of course, the value of goods, services, or the different interactions and relationships that sustain us in our communities – these values are not limited to how they are defined or measured by money and financial markets. These definitions are provided to help understand how mainstream concepts are used. In turn, this will help in critically analysing their political, social, and economic impacts. It will also help when developing alternative approaches that may prioritise different understandings or systems of value.

First, money functions as a medium of exchange. Imagine living in an economy where there is no money. In this type of economy, people must barter with each other, so that they have all the goods and services they need. For example, let us say that Sophia is a farmer and she produces apples. Every time a storm comes in, her barn gets damaged and needs the services of a repair person. Sophia must find a repair person who is in need of apples, so that they can exchange goods (apples) and services (repairing/enhancing) with each other. In a modern economy, money serves as the medium for this exchange. Sophia goes to the market and sells her apples for money. By using the money she earned, now she can purchase any goods or services she needs, which in this case is the services of a repair person.

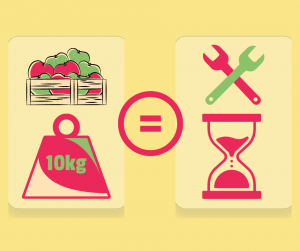

Second, money functions as a unit of account. Without money, it is difficult to measure the value of goods and services. For example, how do we know how many apples are equivalent to one visit to the doctor’s office? Money gives us a common denominator in which we can measure the value of any goods or services and compare them against each other. For instance, let us say that 1 kilogram of apples is worth $5 and one hour of work by a repair person is $50. Then, we can say that 10 kilogram of apples is worth one hour of work by the repair person. So, money provides us a ground to simplify the exchanges in the market.

Second, money functions as a unit of account. Without money, it is difficult to measure the value of goods and services. For example, how do we know how many apples are equivalent to one visit to the doctor’s office? Money gives us a common denominator in which we can measure the value of any goods or services and compare them against each other. For instance, let us say that 1 kilogram of apples is worth $5 and one hour of work by a repair person is $50. Then, we can say that 10 kilogram of apples is worth one hour of work by the repair person. So, money provides us a ground to simplify the exchanges in the market.

Third, money functions as a store of value. To understand this function of money, we should think about savings, instead of exchange. People might want to store goods for future use, but they risk things losing their value during the period of storage (e.g. food perishing, clothes going out of style, etc.). In this case, the function of money is to store the value produced from the goods or services. In other words, people can store the money without worrying about it losing any value in the future. An exception to this rule is when there is inflation.2 Pettifor, A. (2017). The Production of Money. (pp. 28–29).

These seemingly neutral definitions and functions of money can be misleading; creating the illusion that money is a natural phenomenon, that this is the way things have to be. There are alternative theories of and approaches to money that are in contrast with the above views.

For example, Ann Pettifor argues that money is first and foremost a social construct whose meaning is given by social arrangements and social relationships primarily based on trust. Money (and rate of interest) can be considered as the measure of the trust. For example, if the banker does not trust your ability to repay, they will demand a higher interest rate.

An illustrative example to understand this notion is the use of credit cards or store credit. Every time people use a credit card or store credit, they engage in complex social arrangements. Having a credit card or store credit means a ‘promise’ given to the bank or store owner: you promise to repay the debt resulting from the purchases on your card at a given time in the future.

The role of money in terms of savings also includes a social relationship. In a non-monetary economy (when people save/store their wealth in the form of products), it is an individual act. In a monetary economy, financial saving is a social relationship that always affects others. For example, when we deposit our money into a savings account, the bank has a liability to us. In other words, savings and debts go hand in hand with each other.

In this sense, we cannot understand the true function of money without referring to the complex social relationships that it is embedded in. The monetary economy, credit, and banking systems can all be used to improve the lives of people. However, their current form only serves the interests of a small group of wealthy individuals.

While we see money as an exchange system in nearly all aspects of our lives, alternative mechanisms are possible:

“Women in Mexico have created a moneyless economy project created by and for women and everyone they know. In El Cambalache everything has the same value: people exchange things they no longer need for things they want as well as knowledge, abilities and mutual aid that people would like to share. El Cambalache was built on anti-systematic, anti-capitalist values of local social movements.”

– AWID, Feminist Realities

Advocacy pressure points for gender equality and macroeconomics: Further resources

Advocacy pressure points for gender equality and macroeconomics: Further resources  Banking system

Banking system

Footnotes

- 1See OpenStax Economics. (18 May 2016.) Principles of Economics. Chapter 27.1 “Defining Money by its Functions”

- 2Pettifor, A. (2017). The Production of Money. (pp. 28–29).