Basic concepts of macroeconomics: Further resources

Basic concepts of macroeconomics: Further resources  Main institutions of macroeconomics: World Bank

Main institutions of macroeconomics: World Bank

Annexe II: Main institutions of macroeconomics

IMF

The International Monetary Fund (IMF) is an international financial institution with 189 member countries. Since its founding in 1944 during the United Nations Bretton Woods Conference, the IMF has been an important actor shaping the world economic order.1For further information on the IMF and its functions, see its Articles of Agreement. The IMF positions itself as a global norm-setter in economic policymaking and a repository of knowledge about international development and finance. The main mission of the IMF is to oversee the international monetary system to ensure its stability. To realise this agenda, the IMF assumes three distinct functions: surveillance, lending, and technical assistance.

First, the IMF assumes a surveillance function (article IV of the Articles of Agreement of the IMF) at bilateral (member states) and multilateral (regional and global) levels. It exercises firm surveillance over fiscal policies and the general economic state of its member countries, and monitors economic development within regions. Through this surveillance, the IMF makes policy recommendations for economic stability.

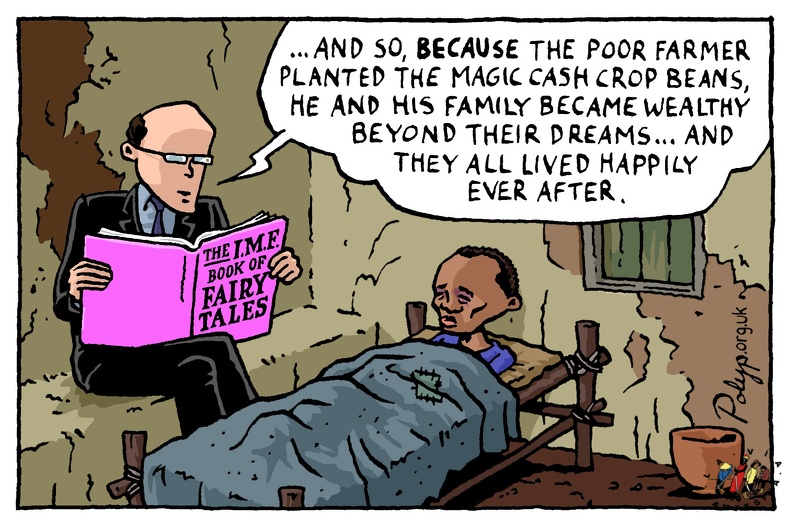

Even though these recommendations are non-binding, abiding by them can be critical, especially when states apply for loans. In other words, the lending activities of the IMF provide it with leverage in enforcing its policies, especially for low-income countries and emerging markets. Furthermore, the IMF utilises its surveillance function more aggressively in low-income countries. It penetrates issues as broad as management of aid flows, natural resources, poverty, and employment. The surveillance function of the IMF and its enforcements of its macroeconomic policies have been harshly criticised by civil society organisations, as these activities have undermined the states’ capacity to fulfill their human rights obligations and also deepened inequalities.2Bretton Woods Project. (6 December 2018). IMF Surveillance.

The second function of the IMF is lending. The financial resources of the IMF largely come from its member countries. The IMF assigns a quota (a set amount of money) to each member country, based on the size of its economy. Then, the IMF uses its financial resources to lend money to countries in need (e.g. countries that cannot make their international payments) on a conditional basis. Known as ‘the principle of conditionality’, the IMF imposes specific economic and policy conditions that countries must meet before they can access the loan.

One of the major conditions that the IMF imposes includes austerity measures (also called ‘belt-tightening’) which aim to reduce public spending. This ensures that the borrowing government would be able to pay their debt back or receive new loans. The IMF has been widely criticised for its austerity policies and its bias towards privatisation and increasing regressive taxes such as VAT. These policies have primarily curbed public spending on education, health, care services, public housing, or infrastructure in diverse contexts since the 1980s.

One of the major conditions that the IMF imposes includes austerity measures (also called ‘belt-tightening’) which aim to reduce public spending. This ensures that the borrowing government would be able to pay their debt back or receive new loans. The IMF has been widely criticised for its austerity policies and its bias towards privatisation and increasing regressive taxes such as VAT. These policies have primarily curbed public spending on education, health, care services, public housing, or infrastructure in diverse contexts since the 1980s.

IMF also acts as a norm setter in global economic contexts. It influences the macroeconomic decisions throughout the world without any impositions, even in countries where there are no IMF programmes in place. This leads to these types of policies being used throughout the world, often without consideration of their impact on the ability of governments to meet their human rights obligations. When these kinds of economic policies take hold in already fragile economies, it often produces long-term negative effects for vulnerable populations. This includes poorer communities or those with low incomes who may rely on the public sector for crucial services.

Of course, this is a particularly important issue in the context of women’s human rights,3For more information on the impact of austerity policies on gender equality, see Section II of this starter kit. as women make up the largest percentage of the world’s poor. This is due to structural inequalities, with overlapping economic, demographic, and socio-cultural factors such as: high concentration in low-paying jobs or being paid lower wages than men for the same work (the gender pay gap), unpaid care burdens, lower rates of decent employment, and gender stereotypes and longer working days.4Bradshaw, S., Chant, S., & Linneker, B. (2018). Challenges and Changes in Gendered Poverty: The Feminization, De-Feminization, and Re-Feminization of Poverty in Latin America. Feminist Economics, 25(1), 119–144.

Finally, the IMF provides technical assistance to mainly low- and middle-income countries to manage their economies. Technical assistance is often in the form of practical guidance and training, aiming to improve the implementation and design of economic policies.

Through these three core functions, the IMF wields significant influence and control over the national economic policies of the states around the world.

For more information on the impact of the IMF on gender equality and feminist responses, see the Bretton Woods Project (2017) The IMF and Gender Equality: A Compendium of Feminist Macroeconomic Critiques.

Basic concepts of macroeconomics: Further resources

Basic concepts of macroeconomics: Further resources  Main institutions of macroeconomics: World Bank

Main institutions of macroeconomics: World Bank

Footnotes

- 1For further information on the IMF and its functions, see its Articles of Agreement.

- 2Bretton Woods Project. (6 December 2018). IMF Surveillance.

- 3For more information on the impact of austerity policies on gender equality, see Section II of this starter kit.

- 4Bradshaw, S., Chant, S., & Linneker, B. (2018). Challenges and Changes in Gendered Poverty: The Feminization, De-Feminization, and Re-Feminization of Poverty in Latin America. Feminist Economics, 25(1), 119–144.